Every banker should pay attention to the topics discussed at the Massachusetts Bankers Association’s Women in Banking Conference. Topics drifted from Storytelling as a Leadership Tool (my portion) to how to develop your personal brand and technology game changers. As it turned out, the topics fit together nicely.

Part of my message was for bankers to realize that they are under attack. The public equates banks with bailouts, fraud, greed and a list of other negatives stemming from the Great Recession, which the media have pinned on banks. Regulators, pushed by elected officials such as Sen. Elizabeth Warren, have imposed 22,000 new pages of regulations on banks, allegedly to make them safer. Finally, banks’ next generation of customers is quickly adopting advancing technology—and banks are behind.

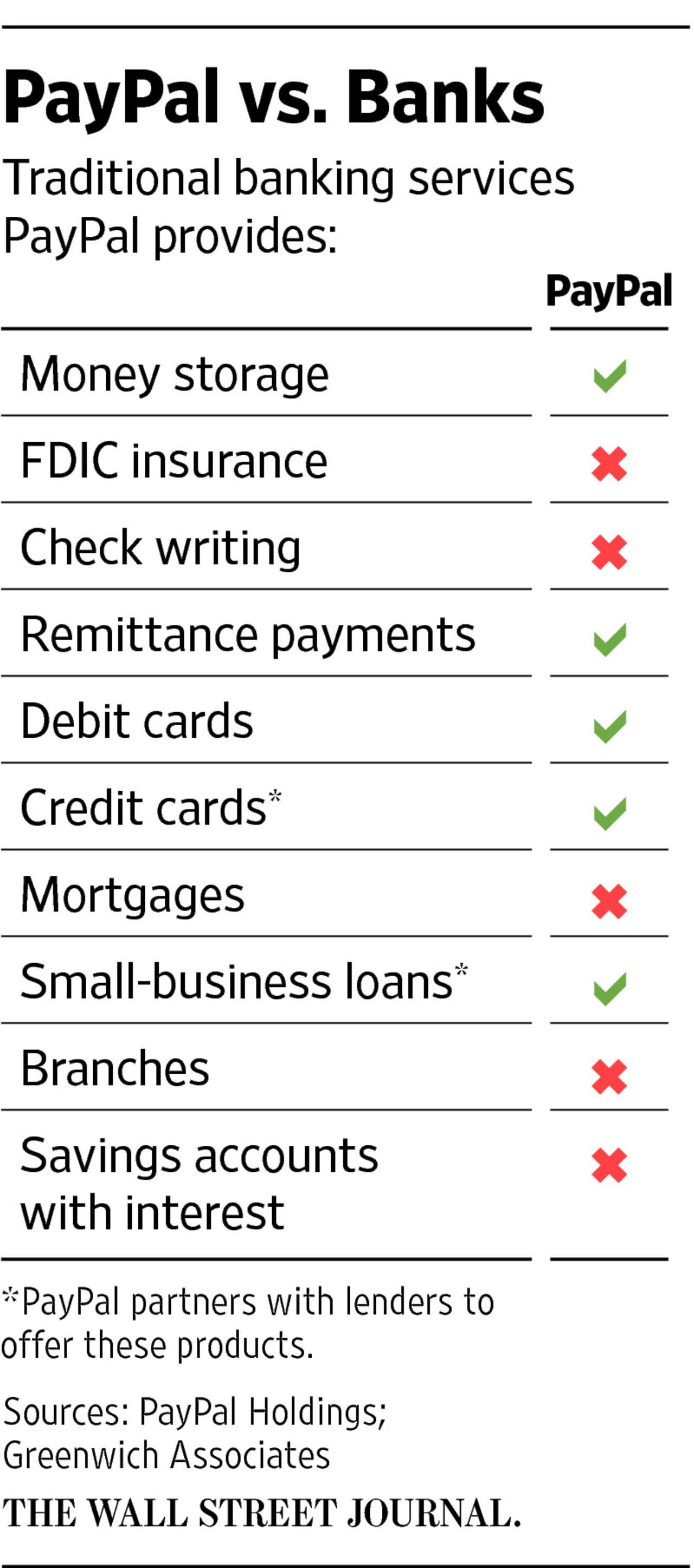

Virginia Hayburn, vice president of strategic insights at Fiserv, identified five technology threats: invisible payments, instant money movement, the internet of things, data-driven relationships and mobile everywhere. I showcased two sections of the Wall Street Journal as props, quoting these headlines, “PayPal Isn’t a Bank, But It May Be the New Face of Banking,” and “What is a Bank?.” The first article pointed out that PayPal holds more customer money than all but 20 banks. It contained a helpful chart comparing the services banks and PayPal both offer: checking accounts, remittance payments, debit and credit cards and small business loans. Still exclusive to banks are FDIC insurance, check writing, mortgages, branches and savings accounts that (allegedly) pay interest.

“I don’t see one philosophical reason PayPal isn’t a bank,” Frank Rohde, CEO of a tech firm serving big banks, said in the article. “They can offer an account, a payment app and a loan.” More and more people agree – but PayPal isn’t regulated like banks, isn’t subject to things like the Community Reinvestment Act and is growing, while there are some 2,000 fewer community banks than in 2008. Meanwhile the biggest “too big to fail” banks have grown bigger. The “what is a bank?” article explored banking’s “existential crisis” and what the future holds. Hint: even more threats and change.

Getting Emotion Back Into the Conversation

Since all the conditions and threats noted above are true, what do banks have to compete with all of this negativity? Banks have the most powerful resource at their disposal: their people, their employees and their customers. And technology has also empowered banks to enlist their employees and people – still subject to all the compliance strictures – in new ways.

I recommended that banks organize their messages into two strategic buckets to talk about: they are committed to helping each individual customer, and they are ardent contributors to their communities. Notice words like “good service” and “important economic contributors” aren’t at the top of my list. They are, of course, true and important, but banks need to get emotion back into the conversation.

We divide communication into very specific parts: clear headlines – something easy to hear and repeat, anchored by an organization’s “good” words– supported with facts and statistics always made relevant to the audience and then examples, stories and third-party quotes.

Other organizations are using anecdotes in conjunction with statistics and are making great strides. Are you moved by hearing your local United Way raised $73 million for 160 agencies last year? Or are you moved by hearing the story of the child rescued from an abusive home and brought to a facility that allows law enforcement and relevant agencies to interview him only once using video conferencing, sparing the child the need to repeat his horror multiple times? At the end, he’s helped to a room to pick out new things. As he builds his pile, he’s asked what the one thing is that he wants. His answer: “A toothbrush because I’ve never had one of my own before.” (This is a true story.)

This example also raises the problem of statistics, bankers’ refuge. Numbers have to be put into context to mean something. If you read that a local bank gave $25,000 to the local food bank, it means nothing unless you’re disposed to think that $25,000 is a lot of money. If you learn that this enough to fund a full-time staff member for a year, or that it lets the food bank open on Sunday afternoons, then the impact is more apparent.

Teaching Bankers How to Tell Stories

The challenge for a bank is identifying its strategic buckets and developing strong headlines, collecting the proof points (especially the stories) and then teaching people how to think, speak and communicate with that structure and to understand that it applies to all communication.

Let me walk you through an example from the conference. At lunch, 300 women participated in an exercise where we paired up and told each other a story with the instructions, “Begin by describing your proudest accomplishment.” All the women in attendance had been nominated to attend because of their leadership or their potential, although the young banker next to me was early in her career. She said she didn’t have a “brand,” but she gamely tried the exercise, saying, “My proudest accomplishment is my work on our vendor management program.” The look on my face gave me away. “That’s not very impressive, is it?” she asked. I suggested we walk through it with our structure.

We started with the program itself. What does it mean? “Vendors are very important to the bank.” That’s a single issue making a claim. What did she do? She began by saying that she helped with the program. With some prompting, it turned out she made a significant contribution, that she had taken it on because of the potential to improve a long list of functions, that no one else wanted to do it, that the bank had hundreds of vendors and that when she rolled it out and briefed her colleagues individually, they initially rolled their eyes but were affected by her enthusiasm. A little more prompting and the question, “If those colleagues were here, right now, what would they say about your involvement in the project and the results?” They would say they felt differently, that she had made it simple and that they appreciated her taking on the task.

Now asked for a story, she said:

(Headline) “Vendors are very important to our bank.”

(Headline) “I made a significant contribution to managing them.”

(Fact) “We have literally hundreds of vendors.”

(Fact) “No one else wanted to do it. They thought it was actually a pain.”

(Story) “I briefed each person individually. When I started rolling out the plan, they rolled their eyes, but I told them all about what I found and why it mattered.”

(Third-Party Quote) “Almost each person I met with said this was very worthwhile and that they were glad I had tackled it. Many said my explanation changed their minds.”

In other words, storytelling isn’t just twisting the heart with a story of a kid who wanted a toothbrush, it’s developing an approach to ordering and conveying messages that can be taught, learned, replicated and shared. That is, anyone who heard this “story” could repeat it and identify it as coming from one of their young bankers.

And, this young woman’s “brand” is that she’ll take on any task, do it enthusiastically and well and bring others with her. That’s anybody’s definition of good leadership.

The next step is to collect and share stories about how banks help their customers and their contributions to the community and how to get others involved in passing them on.

The nation’s community banks are the very epitome of good corporate citizens. Each and every one of them encourages their employees to volunteer, supports almost any local cause that needs help and views itself as committed to good stewardship and good citizenship. Visit the website of any community bank and you see a myriad of pictures of employees at local fundraisers, pie eating contests, Special Olympics events, job fairs, veterans’ events and more.

Several suggestions:

One skill that all bank executives need to master is talking to their internal and external audiences on video, preferably via a mobile device. Many executives are used to being interviewed and recorded. The next level of skill is to be able to talk to people as individuals through a camera rather than just at it. I call it video-enabled person-to-person communication. Video allows an executive to share a story with all employees one-on-one and on their own time schedule. They can watch when they want.

I argue that it’s not the end, but rather the beginning. Storytelling combined with a structured way of sharing your bank’s messages is what is needed to counter the naysayers. You have a great story to tell; make it everyone’s responsibility to tell it.

You May Also Like

We have several celebrity BIMBOS this month and an example of why Twitter should be seized from two immature celebrity singers who utilize the * key too much. This month also features examples from convicted exchange student Amanda… more

We have BIMBO comments from a former New York Times editor, former South Carolina Governor (and, apparently, Republican candidate for president) Mark Sanford, Cory Booker’s campaign manager plus Former FBI Deputy Director Andrew McCabe. Examples of the Power… more

Thank heavens election season ends today! Maybe we’ll take a breather from political BIMBO comments for a little while, but for now, we have a roundup of bipartisan political winners. Additional BIMBO comments come from an executive at… more